Best Payroll management software will be discussed in this article. You are the one to blame if you are complaining about mismanagement in your business operations while relying on long excel sheets to keep track of your capital, taxes, and employee wages. As your company grows, so does its operation, necessitating a larger workforce, more cash, and higher expenses. With money flowing in & out of accounts, a corporation must keep track of and compute taxes, as well as maintain regular payments and company contributions to employee allowances. These are just a few of the many aspects of business capital management, and you can’t do it without making mistakes if you rely just on manually prepared excel sheets.

Payroll Management Software is meant to automate these operations and assist you in accurately tracking cash flow in and out of your company. If you desire to be sure you never miss a payment or make manual calculations errors while paying taxes and salary to your employees, look into one of the payroll management software options below and pick the one that best matches your company. So, here are some of the most OK payroll software options that can help you with capital management.

Top 10 Best Payroll Management Software in 2022

Top 10 best payroll Management software are explained here.

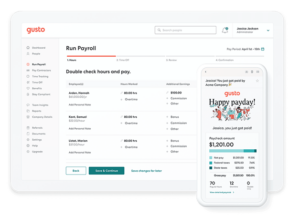

1.Gusto

Gusto is one of the finest payroll management software options, with a slew of tools for keeping track of employees’ pay, automatic filings and deductions, and other allowance expenses. It’s an integrated platform that may be used in conjunction with other e-payroll systems, such as Xero and QuickBooks, to keep track of corporate finances. This means that you can keep track of your employees’ salary as well as your other expenses. Also check Email Verifier And Validation Software

Employees also have individual account access to Gusto’s payroll management system, which allows them to oversee their paychecks, tax filings and deductions, and benefits on a single platform.

- Files for payroll taxes automatically and deducts exact amounts for individual attendance.

A time-tracking component in the payroll management software determines the exact number of paydays for employees.

- Allows for extensive payroll analysis and statistics by separating company spending into employee benefits, allowances, and medical services.

- Allows individual access to employees and maintains payroll transparency between the company and employees.

- It’s possible to merge it with accounting software such as QuickBooks.

- Assist with the creation of offer letters, team surveys, and other HR-related materials.

2. Quickbooks Pro

The QuickBooks payroll management system has a lot of integrations and is undoubtedly one of the most user-friendly e-payroll systems. In the fields of automated accounting, capital flow management, and business spending management, QuickBooks has a slew of solutions. With QuickBooks payroll software, you may maintain a single, integrated platform that will handle the majority of your company’s financial difficulties.

If you’re looking for a complete overhaul of capital flow monitoring in all forms, both in and out of your company’s accounts, this is the best payroll management software.

Characteristics:

- Automated pay stub and tax computations

- Has a facility for employees to examine their salary payments and track withholding allowances through a workforce portal.

- Worker’s compensation and other benefits are managed.

- The remaining QuickBooks interfaces allow for complete money flow management within a company.

- The HR Support Center is a website that assists businesses in complying with federal wage policies, learning best practises for hiring, and accessing other onboarding resources.

3. Run by ADP

Run’s services are divided into four separate plans. These plans cover services ranging from a basic e-payroll system to a more advanced payroll management system that includes human resource services, and as the plan evolves, so do the services.

The four plans are as follows:

- Essential Payroll: A straightforward e-payroll solution that includes salary management and tax filings.

- Enhanced Payroll: Has new capabilities for insurance compliance and other benefits that employees receive as part of their annual wage packages.

- Payroll Complete: Has a distinct module for HR services such as training toolkits, onboarding wizards, forms and paperwork, and so on.

- HR Pro Payroll: Claims to provide expanded support, as well as third-party legal aid, among other things.

- All payroll managing system services, such as tax filing, payroll deliveries, W-2s, & new hire reporting, are available through Run.

- Run is a cross-platform application that may be accessed by mobile, computer, or web.

- Support for automated employee hiring documents, online profile databases, and employee appraisal reports are included in the HR services offered by Run’s higher plans.

- Other features include HR toolkits, training modules, and other services.

4. On Pay

On Pay, one of the finest payroll management software options, is ideal for both small enterprises and huge corporations with various departments. While the payroll software includes payroll services like as tax filings, payment monitoring, and payment scheduling, it also offers a classified database management system to handle payments made to contractors and temporary employees.

Multiple accounting software and time-tracking platforms, as well as numerous HR services, can be integrated into the e-payroll system.

- Manage numerous payment schedules for different employees and contractors using this feature.

- Maintain a database for various payment and transaction methods.

- Produces automated offer letters & HR documentation for easier contact between the organisation and employees dispersed across multiple departments. • Chat capability to communicate with employees via a mobile app.

5. Wave Payroll

Wave is best recognised for its free payroll management software, which includes accounting services, sales management, and a payroll management system all in one place. Wave is well-known for its comprehensive account management and quick cash flow and profit/loss margin monitoring.

The employee payroll system, on the other hand, is one of Wave’s best business software features. However, payroll functions primarily comprise important monitoring of regular wage payments, tax deductions and filings, and other expenses, which are automatically computed with other costs.

Wave Payroll is an integrated capital management software with a payroll management system that supports all key payroll functions such as salaries, employee databases, tax deductions, information on paydays and pay cutbacks, and more. It is free of charge with no hidden fees.

- Statistical data monitoring makes cash flow and payroll expenses easier to examine for administrators.

6. Xero

Xero Payroll is an accounting software that integrates with Xero. It can, however, be used alone as payroll management software. Xero provides its users with a straightforward and simple-to-understand experience in addition to its payroll management services. Timesheets for managing employee attendance, pay calendars, reimbursement monitoring, leave management, and other capabilities are included in the e-payroll system. Also check webinar software

All of these capabilities, in addition to payroll functions such as salaries and employee databases, make the software more complete and automated. Employees can also view their payslips, leaves, and timings in real time via the Xero mobile app.

- Xero includes a payroll management system as part of the package, but it can also be purchased separately as company software.

- The Xero payroll management software allows for single-touch payroll, which means that salaries are directly credited to employee accounts via integrated bank accounts.

- Xero includes additional capabilities for tracking work hours and vacations.

- Xero includes a calendar that can be used to arrange automated payments to employees.

- Employees may log their work hours, leave, and payslips with the Xero mobile app.

- By integrating with Xero Accounting, salaries will be merged as outgoing expenses, resulting in a fully integrated capital flow management solution for the company.

7. Zenefits

A software that combines HR and payroll management and allows for the tracking and management of salaries, salary adjustments, employee work schedules, leaves, and more. Zenefits’ features do not gradually distinguish it from the others on the list, but it does outperform a few in terms of user interface and convenience of use. In addition to leave management and timesheets, Zenefits considers employee perks when generating an accurate and complete payslip for employees and tax filings.

- Salary changes are automatically synchronised.

- Benefits to employees are considered.

- Work schedules and vacations are well-managed.

- Employees may request leaves straight from the app, and Zenefits’ HR services automate the onboarding process.

8. Patriot Payroll

Patriot is the best payroll software for small to medium business owners with up to a hundred employees. It’s simple to use, affordable, and packed with features that will help you complete all payroll and tax filing procedures effortlessly. The software includes an employee portal that allows employees to track their pay and leave requests, as well as a function that allows for direct salary deposit from linked bank accounts.

Patriot offers to automatically fill in all types of taxes, such as federal payroll taxes, deposit taxes, year-end filings, and so on. Patriot is noted for its precision in tax deductions and other calculations.

Characteristics:

- Is tailored to the needs of small and medium-sized businesses.

- Employee portals can only be managed for a total of one hundred employees.

- Is accurate in tax deductions and offers all employees electronic tax filings.

- Can be incorporated with specialised accounting software to provide a full e-payroll system.

- Allows for direct salary deposits and check printing.

- Have track of employee time off and keep a separate database for contractors.

- Has the ability to handle pay deposits at various intervals.

9. Sage Business Payroll

Sage Business Payroll is a piece of business software from the Sage Group in the United Kingdom, which specialises in automated accounting, spending, and inventory management. Sage Business Payroll is a payroll management system built specifically for small enterprises with no more than 25 employees. Also check Financial planning software

The payroll management software is a simple e-payroll platform with few bells and whistles aside from tracking timely and correct payments of employees’ paychecks adjusted for tax deductions. The system generates an automated payslip as it calculates wages and provides an easy-to-use payroll management solution.

- Payroll software that is simple to use and geared for small businesses.

- Has the ability to manage up to 25 employees’ wages.

- Is solely a payment management software that tracks salary deposits and tax deductions.

- Other features include tax filing and reporting, as well as employee leave management for correct wage calculations.

- Companies can use Sage to deliver direct payment reports and payslips to employees via email.

- Weekly, fortnightly, and monthly payment rates are available.

10. Paychex

Paychex is an all-in-one HR & payroll management software that allows you to manage employee payrolls, hire and onboard new employees, and track employee attendance. Paychex complies with all IRS requirements and taxes, and is efficient in completing needed tax filings and deducting taxes from individual employee salaries. HR services ensure that employees’ complaints are handled swiftly and with professionalism and compassion. Paychex includes five key features, which are listed below.

Characteristics:

- Payroll: Keep track of all employee salary deposits.

- Human Resources: Assist employees in obtaining direct access to a human resource assistant via the portal.

- Hiring and Onboarding: Automate documentation for new employee hiring processes.

- Perks: Keep track of expenses incurred as a result of employee benefits such as retirement, additional allowances, and bonuses.

- Time & Attendance: Keep track of employee work schedules and vacations in order to calculate pay.

Payroll processing is one of the most difficult jobs in corporate operations since it involves a large amount of money leaving the accounts. Furthermore, it must be accurate because, as a business, you cannot afford to make mistakes in your tax filings and so break some federal rule. These payroll management software streamlines the entire process of employee payroll and tax filings by automating the majority of the work and reducing errors. Such payroll management platforms are vital for all small and large firms since they keep track of employee pay and retain a record of expenses incurred on their behalf from company accounts.