Best and authentic financial reporting software will be explained in this article. Financial management is crucial in any firm, regardless of its size. Maintaining transaction records, collecting and calculating statistics on earnings and losses, creating balance sheets and budgets, budgeting, financial reporting, and forecasting are all part of the financial management process.

The most important role is financial reporting, which entails gathering, calculating, and arranging data from all financial parts of the organisation, such as budgeting, forecasting, and preparing balance sheets, among other things. All of these jobs take a long time to complete and necessitate the use of specialised knowledge in order to produce precise and dependable outcomes. As a result, firms today use financial reporting software to help them with these difficult duties.

Top 12 Best Financial Reporting Software in 2022

Top 12 Best Financial Reporting Software are explained here.

The following are some of the advantages of using good financial reporting software:

- Features that automate the tracking of your financial transactions.

- You can get real-time reports whenever you wish.

- Provides forecasting tools to help you make informed decisions.

- Budgeting and planning functions that assist you in reducing unnecessary expenditures.

- Business intelligence tools that can tell you whether a business plan is profitable.

In this post, we will deliver you with a list of the finest Financial Reporting Software, compare the top 5 of them, and examine the features of each one to assist you in selecting the best one for you.

Pro-Tip: Keep the following in mind while purchasing financial statement software:

- If you have a large company, go for the one that offers the most features. It will pay for itself in terms of the value it provides, even if it is costly.

- If you’re looking for software for a small or medium-sized business, search for one that has only the functionality you need, as they can be simple to use and inexpensive. Avoid the large names that offer a lot of features because they are usually highly expensive.

Check the facts: The Global Financial Accounting Software market is predicted to grow at an annual rate of 8.02 percent from 2018 to 2026, according to Fortune Business Insights. The market was worth $11,071.6 million in 2018 and is expected to reach $20,408 million by 2026.

The following graph depicts the size of the global Financial Accounting Software market:

Most Commonly Asked Questions

What does financial reporting entail, first and foremost?

The following are examples of financial reporting:

- A list of your financial assets and obligations.

- A profit and loss statement is required.

- Data from your many entities consolidated.

- The history of the company’s transactions.

- Estimated profits, sales forecast, budget, and planning for the future year.

What is the purpose of financial reporting?

Q #2) What is the purpose of financial reporting?

Answer: The basic goal of financial reporting is to keep track of your financial inputs and outflows, analyse the data, and generate final reports and statements that reflect your company’s success and advise next moves.

What is the difference b/w an annual report and a financial report?

Q #3) What is the difference b/w an annual report & a financial report?

A financial report and an annual report are two separate documents.

An annual report has a broader idea than a financial report, which provides details of your financial transactions as well as a profit/loss report.

An annual report includes the information found in a financial report, as well as the company’s future growth plans and strategies, a letter from the CEO, and other pertinent information.

Q #4) Which financial reporting software is the best?

Oracle Netsuite, Workiva, Sage-Intacct, Workday Adaptive Planning, CCH Tagetik Wolters Kluwer, FYISoft Financial Reporting Software, DataRails, and QuickBooks Online are some of the best financial reporting software options.

Question #5) How do you put together a financial report?

A report contains information on a specific incident. A financial report, also known as an annual report, is prepared in order to evaluate a company’s annual performance and make better decisions.

Follow these procedures to create a year’s worth of financial reports:

- Make a balance sheet that lists all of the company’s assets, liabilities, and shareholder equity.

- Make a profit and loss statement that includes revenue, expenses, profits, and losses.

- Make a cash flow statement that shows all of your transactions.

- Create a financial strategy that includes sales predictions, a budget for the future year, and projected earnings, among other things.

These duties consume an excessive amount of your time. So, if you want to save time and have more precise and dependable reporting, you should invest in financial reporting software.

#1) Oracle Netsuite

The best feature is that it is an all-in-one solution.

Oracle Netsuite is a financial reporting software that generates reports so you may get a better understanding of your business’s performance and take action on time. This cloud-based software tailors solutions to the size of your company and charges accordingly. Also check Text Editor Software

- Creates reports based on your specifications.

- Cloud based reports can be accessed from any location using a web browser or a mobile device.

- Tools for calculating and reporting taxes; • Tools for preparing income statements and balance sheets.

Oracle Netsuite users have highly recommended the software to small and medium-sized organisations. Oracle Netsuite is a well-known brand in the market, offering a single platform with business solutions spanning from accounting to order processing.

For a price quote, please contact us directly.

#2) Workiva

Best for simple solutions that can be scaled to fit any business size.

Workiva is one of the top financial statement software programmes available, with the goal of making complex jobs easier for your company. The automated features of this cloud-based technology ensure accurate, transparent, and dependable reporting.

- Provides you with a financial report whenever you want it.

- Analytical features that don’t necessitate coding knowledge.

- Allows you to connect your data directly to the report, resulting in a final report that is 100 percent accurate, transparent, and authentic; • Allows you to manage many entities on a single platform.

Conclusion: Workiva users say the software is simple to use, the customer service is excellent, and the software is accessible from any location. On the other hand, the software is said to be costly and that the learning curve is lengthy.

For a price quote, please contact us directly.

#3) Insight Software

Over 5,00,000 people use Insight Software throughout the world. It has automation tools that collect financial data and generate financial reports on their own. You can plan and execute each business choice with ease and precision.

- Financial reporting that is quick, inexpensive, and adaptable.

- Data entry options that are automated to save you time.

- Integrated with Microsoft, SAP, MRI, NetSuite, and other systems.

- Business intelligence software converts your data into reports in a matter of seconds.

- Tax planning and analysis.

Conclusion: Some users have complained that the software’s SMS notifications feature makes it too expensive. The customer service crew is said to be friendly. Overall, the software comes highly recommended.

For a price quote, please contact us directly.

#4) Sage Intacct

Sage Intacct is a financial statement preparation software that saves you time by providing precise data insights and reporting. Sage Intacct adds features such as budgeting and planning, as well as HR and financial reporting.

Capabilities:

- Engage your worldwide workforce with powerful HR features;

- Get custom reports or quick answers for decision-making;

- Cloud-based budgeting and planning features; • Easily exchange data or link with other systems.

Gartner has given Sage Intacct the highest score in “Core Financials” for mid-size businesses (2020).

The users of this simple software strongly suggest it.

For a price quote, please contact us directly.

#5) CCH TagetikWolters Kluwer

Best for being a complete, all-in-one financial platform.

CCH Tagetik Wolters Kluwer is a financial statement analysis software with automation and business intelligence tools that allows you to get real-time reports based on your company’s data. Also check Payroll management software

- Budgeting, planning, and forecasting tools that assist you in making smarter decisions.

- Advanced analytics features for creating predictions, as well as automation and financial intelligence tools to help you generate an annual report, budget book, or profits presentation.

- Boost profits by utilising features that allow you to view profitability from all angles.

Conclusion: The software is said to be confusing at times, but this is due to the large number of functions it provides. The software has a steep learning curve, but once you get the hang of it, it’s simple to use.

For a price quote, please contact us directly.

#6) FYISoft Financial Reporting Software

FYISoft Financial Reporting Software is a quick and easy-to-use software that generates financial statements using business intelligence tools and may be installed on the cloud or on-premises.

- For businesses with several companies, it consolidates data and generates reports.

- Creates professionally structured reports that can be utilised for presentations right away; • Budgeting and planning features; • AI-powered analytics features

Conclusion: FYISoft Financial Reporting Software has received a lot of positive feedback from its users for being quick and simple to use. The ability to distribute reports is also appreciated.

For a price quote, please contact us directly.

#7) Freshbooks

Freshbooks is a personal financial statement software with small business features. Freshbooks’ capabilities include everything from invoicing to budgeting and financial reporting.

- Accounting features that generate real-time reports with profit and loss information.

- The cost monitoring function allows you to keep track of your out-of-pocket expenses.

- The mileage monitoring feature maintains track of how much your automobile travels for business purposes, allowing you to save money on taxes by documenting your expenses.

- Create invoices, track miles, and more with this mobile app.

Verdict: Users have complained that they had good customer support when they first started using the software, but that the fees subsequently escalated, sometimes by as much as double.

Freshbooks is a good financial reporting and budgeting software for small businesses in general.

There is a free trial available. The following are the prices:

- Select: Custom pricing • Lite: $7.50 per month • Plus: $12.50 per month • Premium: $25 per month

#8) Workday Adaptive Planning

When it comes to creating scalable solutions, this is the best option.

Workday Adaptive Planning is a free financial reporting software that you can try for a few days. They provide budgeting, planning, forecasting, and reporting solutions, and Gartner has positioned them as a Leader in the Magic Quadrant for 2021.

- The profitability analysis option allows you to make the best decisions possible in order to maximise profits.

- HR solutions. • Budgeting expenses tool maintains track of your spending.

- Cloud-based features for aggregation, validation, and reporting.

Workday is one of the greatest financial reporting software programmes on the market. The customer support is outstanding, and the scalability features are to die for.

There is a free trial available. For a price quote, please contact us directly.

#9) Budgyt

Budgyt is a cloud-based financial solution for your business that is simple to use and economical. They propose improvements that will make the complex budgeting, reporting, forecasting, and closing processes easier to manage.

Features include: • Constant forecasting, which aids decision-making; and • Budgeting features.

- Hyperlinking and dimensioning features that help with closing.

- Produce reports that are appealing, professional, and accurate.

Budgyt’s financial reporting capabilities are acceptable, but its budgeting capabilities are exceptional. In general, the software is suitable for small businesses.

There is a 30-day free trial available. The following pricing options are available: • Easy: $239 per month • Plus: $479 per month • Pro: $838 per month • Enterprise: Customized pricing

#10) Xero

Xero is a popular financial accounting software that offers a 30-day free trial, streamlines daily business operations, and is used by small businesses, accountants, and bookkeepers all around the world.

Payroll processing is one of the features.

- Creates custom reports based on your specifications.

- Create custom invoices, send invoices, and accept payments.

- Instant currency conversions allow you to pay or receive money in multiple currencies.

Conclusion: Xero users claim that the software is simple to use, economical, and that the invoicing tools are useful for small businesses. According to reports, the financial reporting features are mediocre.

There is a 30-day free trial available. The following are the pricing options:

- Starting out: $11 a month • Growing: $32 a month • Established: $62 a month

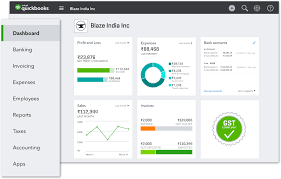

#11) QuickBooks Online

QuickBooks Online is a small business accounting software that handles all of your accounting needs, including payroll processing, invoice creation, bookkeeping, and reporting.

- Time tracking and payroll processing capabilities.

- Send out invoices and accept payments.

- Features related to bookkeeping.

- Get fast access to your cash flows, including profit and loss statements, whenever you choose.

Conclusion: QuickBooks is a well-known brand in the market. Its appeal stems from the ease of use and features it provides for small enterprises. When utilised by large companies, the software, according to some users, has some speed concerns. Also check close captioning software

There is a 30-day free trial available.

The following are the pricing options:

- Self-employed: $7.50 monthly • Simple Start: $12.50 monthly • Essentials: $20 monthly • Plus: $35 monthly • Advanced: $75 monthly

#12) DataRails

DataRails is a financial reporting software with financial reporting automation features. They also have budgeting and planning tools, as well as financial analytics and scenario modelling.

- Filter data from the consolidated finances for inclusion in your report.

- Forecasting and budgeting

- Features to aid you make the right decisions, such as scenario modelling; and features to help you streamline the financial closing process.

Conclusion: The features for planning, reporting, and forecasting are well worth noting. DataRails users claim that the software is cost-effective and ideal for small to medium-sized organisations.

For a price quote, please contact us directly.

Conclusion

In this post, we conducted a thorough investigation into Financial Reporting Software, obtaining information on the best software in the business, comparing them, and providing judgements on each of them.

Finally, we can state the following points:

- Financial reporting is an important responsibility for every company, but it may take up a lot of your time if done manually. As a result, it’s preferable to have financial reporting software that automates the process.

- Financial reporting software available in the market has a variety of other capabilities in addition to reporting. • Oracle Netsuite, Workiva, Sage Intacct, Workday Adaptive Planning, CCH Tagetik Wolters Kluwer, FYISoft Financial Reporting Software, DataRails, and QuickBooks Online are the overall best. • QuickBooks Online, Xero, Freshbooks, DataRails, and Budget are excellent for small firms.