Best Tax Preparation Services: Most households with an income are obliged to file taxes each year, which is why it’s critical to have a strategy in place to complete your tax return before the April deadline. While many Americans prefer to prepare their own taxes using Best Tax Preparation Services (or manually), having someone else do the arithmetic and paperwork for you is the most convenient option.

This is one of the services of hiring a tax preparer. Best Tax preparation services are frequently more expensive than do-it-yourself options, but if your taxes are very complicated, seeing a tax specialist may be a wise choice. Based on reputation, cost, offered services, and other factors, we evaluated tax preparation organizations to find the five top Best Tax Preparation Services.

The Best Tax Preparation Services that is tailored to your specific requirements. Individuals who file their taxes using earnings from a job will have different demands than those who file as self-employed. Also, the complexities of tax credits and deductions may make a person want to hire a professional to help them with their taxes.

What are Best Tax Preparation Services?

Simply described, Best Tax Preparation Services or company that assists people in preparing their tax returns. These Best Tax Preparation Services may also include tax planning, which can help you be better prepared for future tax seasons. Budgeting and bookkeeping, auditing, and tax advice are examples of these services.

While most of these Best Tax Preparation Services are done in person, there are also online tax preparation services available. It’s crucial to keep in mind that Best Tax Preparation Services are just that: preparation. This means they can’t promise a precise tax refund amount or certain techniques to help you lower the amount of taxes you owe.

Top 5 Best Tax Preparation Services & Companies In 2022

The Best Tax Preparation Services is to assist clients in preparing their tax returns using their information. That implies that when you meet with them, you must have all of your ducks in a row and all of your facts in order.

H&R Block

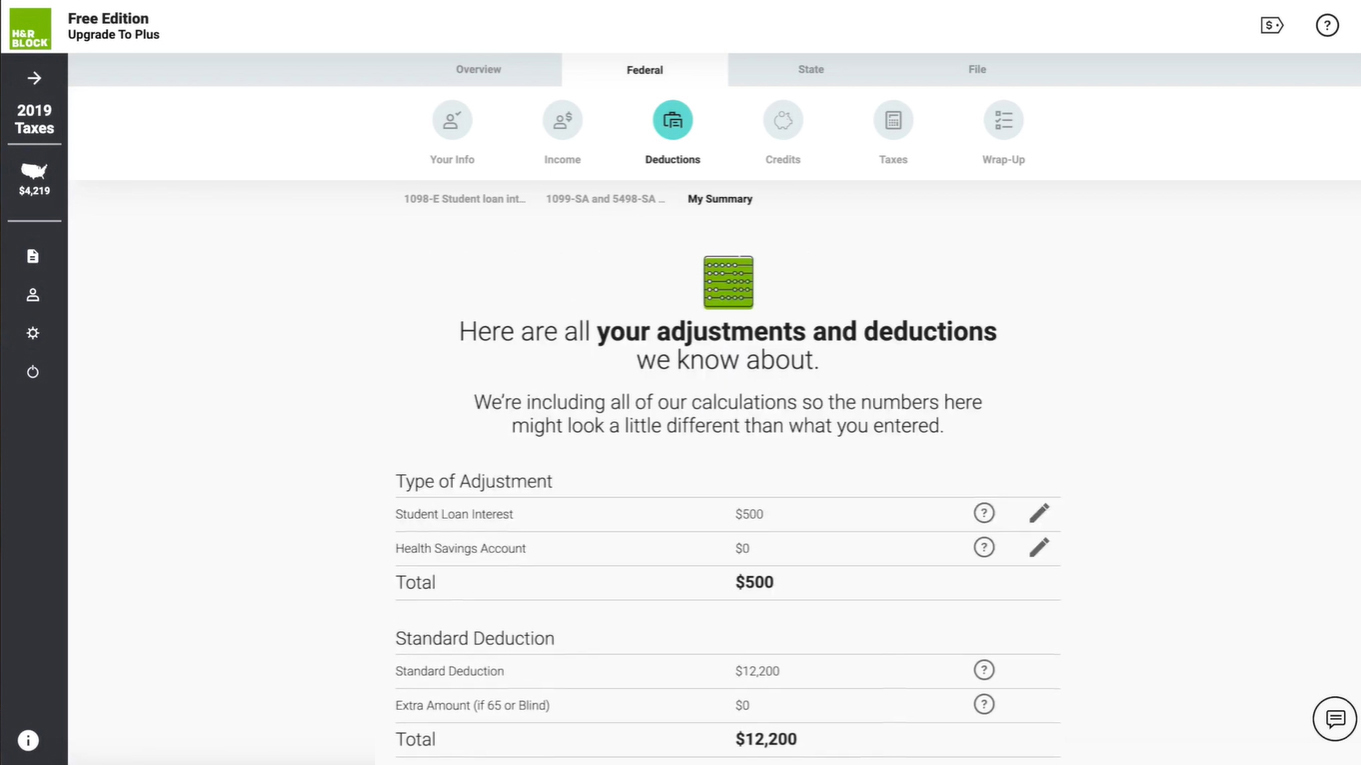

H&R Block is a household name in tax preparation due to its lengthy history in the industry and its extensive network of over 10,000 locations. H&R Block customer evaluations support the company’s professional claims of being among the best in the tax filing sector. It allows you to file in person (or virtually) with an experienced tax professional or use their online services. At H & R Block, most customers will be able to find the services they need.

There are Best Tax Preparation Services available for everything from simple tax return filing to more complicated self-employed tax filing. Online filing services are divided into tiers based on the level of service required. Simple filing is provided at no cost to students, individuals on unemployment income, and W-2 employees. The Deluxe option, which starts at $29.99, may be preferred by those trying to maximize credits and deductions, while the Premium option, which starts at $49.99, may be preferred by rental property owners and investors. For people who operate small enterprises or are self-employed and have individual home deductions, there is now an online alternative beginning at $84.99.

At an extra expense, live professional assistance is available for these online choices. If an online tax preparation service isn’t for you, H&R Block still provides one-on-one tax preparation services in an office or online, starting at $80. H&R Block is a popular choice for a reliable tax preparation service because it has been around for a long time, has good reviews from customers, and has low prices.

This year, Cash App Taxes has been included in our list of the Best Tax Preparation Services. Cash App purchased Credit Karma’s tax service in November 2020, which was formerly known as Credit Karma (which was our No. 4 Tax Software of 2021). Because it’s free to submit your federal and one state tax return, Cash App Taxes is the Most Affordable Tax Software of 2022. You must first download the Cash App mobile app on your phone or computer in order to use the software.

According to the business, you can obtain your refund up to two days faster if you deposit it into your Cash App account. It promises to get you the most money back possible. However, the software isn’t designed for complicated tax situations, and Montana residents can’t use Cash App Taxes to e-file. Jackson Hewitt is a well-known photographer. For more than three decades, Jackson Hewitt has specialized in tax preparation.

Jackson Hewitt

It has more than 5,500 sites, half of which are within Walmart shops. Because of how different these sites are, people looking for Best Tax Preparation Services have another option. In addition to the services provided by on-site tax experts at the locations listed above, Jackson Hewitt now provides online tax filing choices and virtual filing with tax specialists. For federal files, simple online tax filing starts at $25. From simple filers to self-employed and more difficult tax filers, virtual choices with tax specialists run from $69 to $249, depending on necessity. On-site charges may vary due to the franchise aspect of some Jackson Hewitt operations. For the most accurate cost, call the one closest to you.

TurboTax

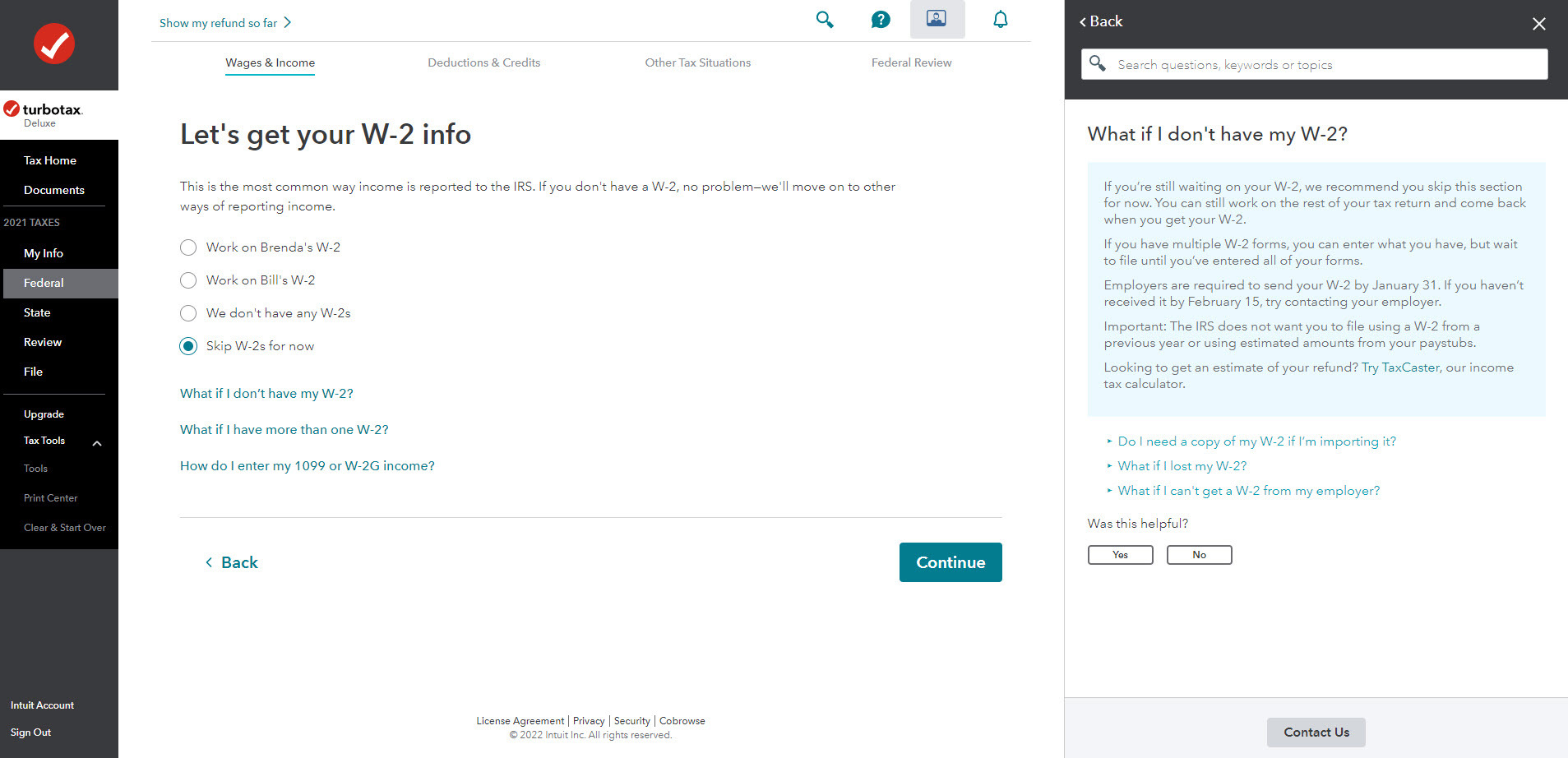

Some consumers prefer the in-person choices provided by the mentioned tax preparation services. Others may want to prepare and submit their taxes using tax preparation software or online solutions. TurboTax may be a good fit for you if you fall into the latter category. TurboTax’s services are available both online and as software that can be bought at most stores.

There are no shops or offices to go to. TurboTax is a wonderful tax preparation alternative for folks who like to do their own work. But that doesn’t mean you can’t get expert help if you need it; TurboTax Live is a service that lets you work with a tax professional to finish your taxes. Customers can use TurboTax to file their federal and state taxes by answering a series of questions in an easy-to-understand, step-by-step format, as long as they have all the necessary tax forms and paperwork.

A free edition is available for uncomplicated returns, W-2 workers, and unemployment income. People who want to get the most out of their deductions and credits and people who own or rent out property can choose between the Deluxe and Premier online options, which start at $39 and $79, respectively.Self-employed people have a personal and business option that starts at $89.

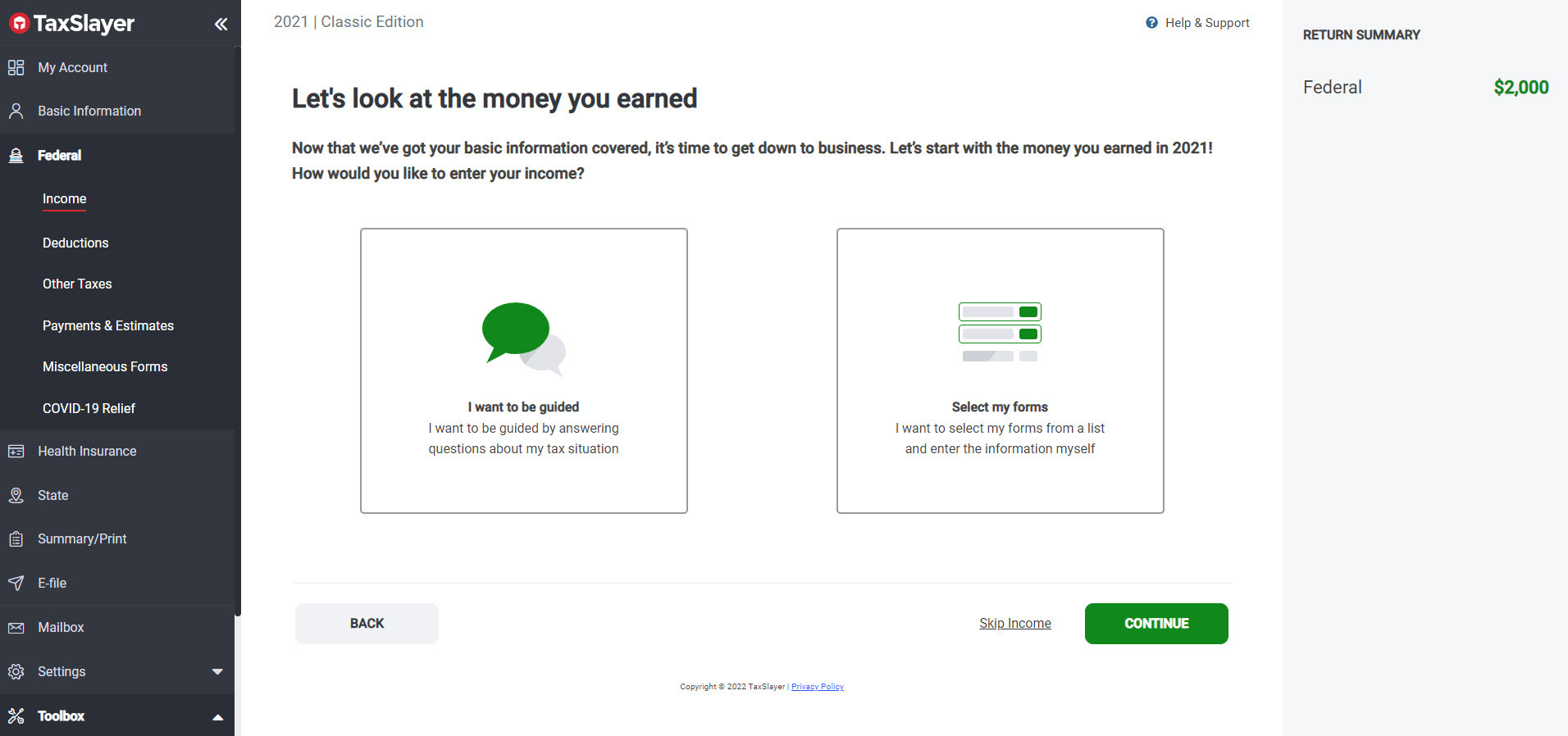

For completing your tax return online, TaxSlayer provides four alternatives. It has a free edition and then goes up to $47.95 for self-employed taxpayers (normally the most complex of tax scenarios). For the top-three tier items, filling out a state return costs an extra $36.95. In the free edition, there is no charge for state returns. If you need assistance filing your taxes online, TaxSlayer’s premium service could be right for you.

It costs $37.95 and includes live chat and the chance to ask a tax professional for help during the filing process. You can use TaxSlayer’s mobile app to file your return if you know what you’re doing and don’t need help. Active duty military personnel can also get free tax filing through the firm. What is the most efficient method for filing taxes?

Also See :

What are the best methods for Filing Taxes?

There are just possibilities available to you. Let’s take a quick look at each one:

- For manual filing, you have to fill out Form 1040, the Individual Tax Return Form, by hand.

- Once you’ve finished it, send it to the IRS along with any payments you owe.

Software-assisted Best Tax Preparation Services:

- In these current days of e-filing, tax software tools are standard.

- These tax apps or websites offer services that help users through the process by asking a series of questions about taxable income, deductions, and other things.

- These should be saved in an electronic format.

- Services and preparers of tax returns

- Some folks choose to hire a tax preparer.

- A tax preparation service will assist clients in filling out the required tax forms and maximizing their returns.